|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

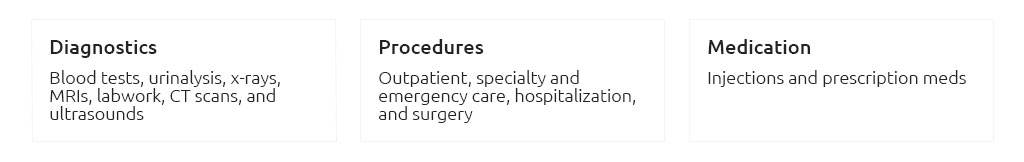

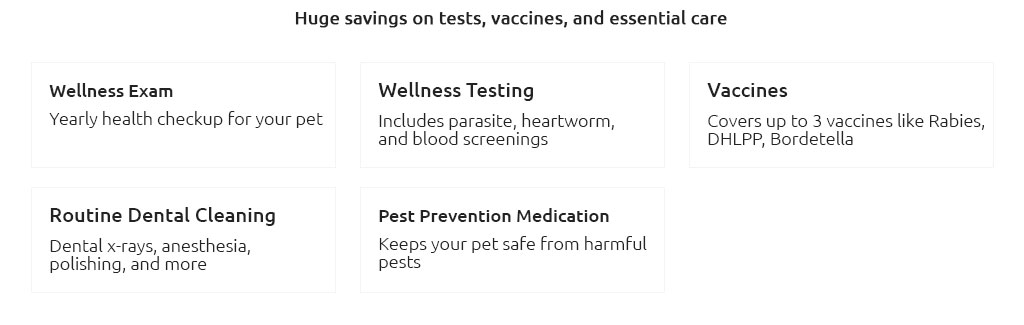

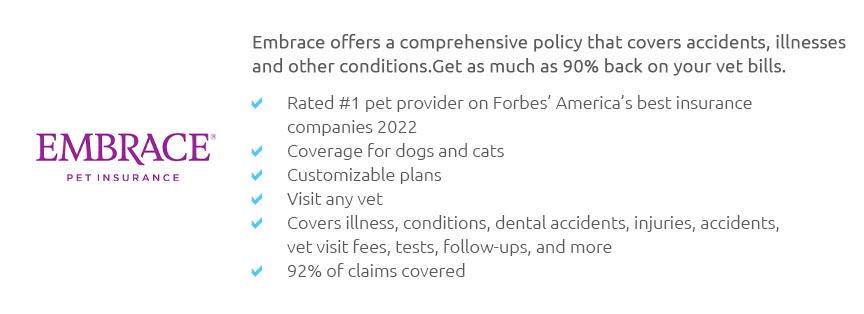

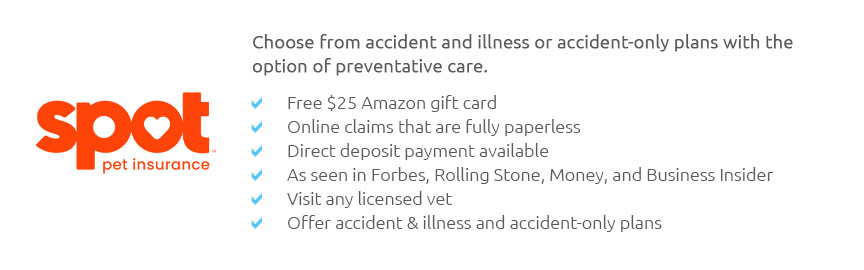

Husky Pet Insurance: What You Need to Know for Your Furry FriendUnderstanding the Importance of Husky Pet InsuranceOwning a husky can be both rewarding and challenging. These energetic dogs are known for their high activity levels and unique health needs, making pet insurance a crucial consideration for any husky owner. Huskies, like any other breed, are prone to certain health conditions. Investing in a suitable insurance plan can help cover unexpected veterinary bills, ensuring your pet receives the best care possible. Key Features of Husky Pet InsuranceCoverage OptionsWhen selecting insurance for your husky, it's important to understand the different coverage options available. Most pet insurance plans offer:

Cost ConsiderationsThe cost of insuring a husky varies depending on factors such as age, health, and location. It's essential to compare multiple plans to find the best value. For tips on selecting the right plan, visit how to choose pet health insurance. Steps to Apply for Husky Pet InsuranceApplying for pet insurance can be straightforward if you know what steps to follow.

For a detailed guide, refer to how to apply for pet insurance. FAQWhat health issues are common in huskies?Huskies are prone to hip dysplasia, eye disorders, and skin conditions. Regular check-ups and a suitable insurance plan can help manage these issues. Is it worth getting pet insurance for a healthy husky?Yes, even healthy huskies can face unexpected accidents or illnesses. Pet insurance ensures you're financially prepared for such situations. How do I choose the best pet insurance plan for my husky?Consider your husky's age, health history, and your budget. Compare plans that offer comprehensive coverage and fit your specific needs. https://www.healthypawspetinsurance.com/blog/dog-breeds/husky-breed-guide-and-insurance-plan

Huskies are fast, powerful, friendly, energetic, and have great endurance. They can do well as both working dogs outside and family dogs in a home. https://www.fetchpet.com/pet-insurance/breeds/husky

The average monthly premium for a Siberian Husky in the U.S. is $34. The most common limit is $5,000, The most common deductible is $300, and the most common ... https://manypets.com/us/pet-insurance/dog-insurance/pure-breeds/siberian-husky-insurance/

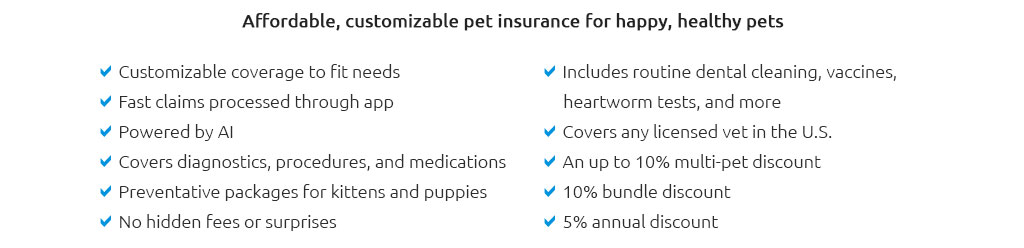

ManyPets offers top-ranked pet insurance coverage for Siberian Huskies, covering care at any licensed vet.

|